Commodities

Real-time commodity prices, market analysis, and news for precious metals, energy, and agricultural markets.

Commodity Prices

Commodity Sectors

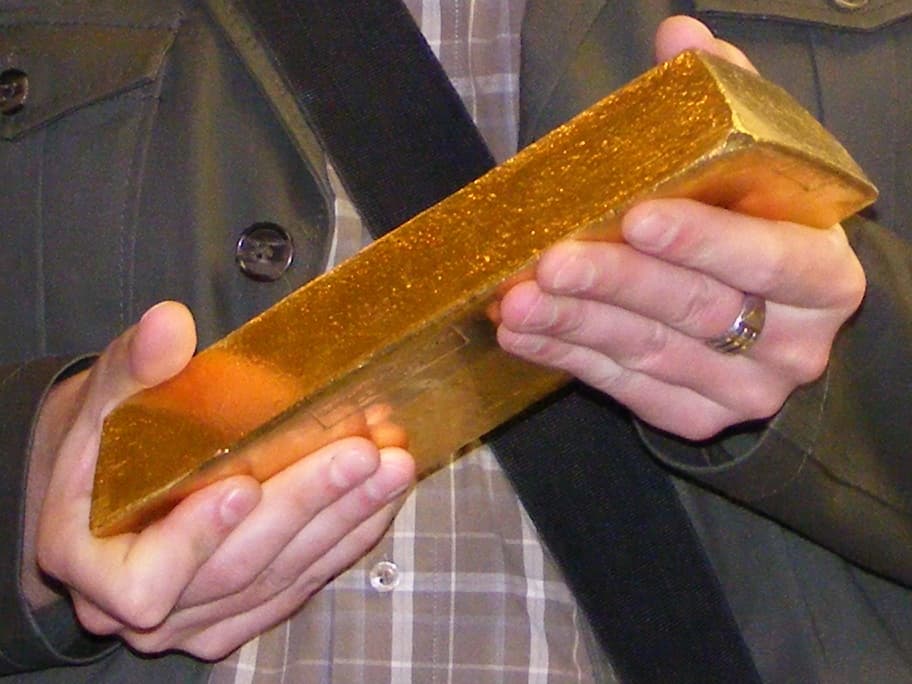

Precious Metals

Gold, silver, platinum, and palladium. Traditional safe-haven assets that preserve wealth during economic uncertainty.

Energy

Crude oil, natural gas, and heating oil. Energy prices are driven by global supply and demand, OPEC policy, and geopolitical events.

Industrial Metals

Copper, aluminum, and zinc. Industrial metals reflect manufacturing activity and economic growth expectations.

Agriculture

Corn, wheat, soybeans, and coffee. Agricultural commodities are influenced by weather, crop yields, and global food demand.

Market Commentary

Gold prices edged higher as the dollar weakened on dovish Federal Reserve commentary. The precious metal continues to benefit from geopolitical uncertainty and central bank buying, with several major institutions increasing their gold reserves. Gold is up over 15% year-to-date, outpacing most equity indices.

Oil prices retreated as concerns over global demand growth offset OPEC+ supply discipline. Crude oil futures fell below $75 per barrel as Chinese economic data disappointed and U.S. inventories built more than expected. The energy sector remains volatile as markets weigh the pace of the global energy transition.

Agricultural commodities saw mixed trading, with coffee surging nearly 5% on supply concerns from Brazil due to unfavorable weather conditions. Wheat and corn remained range-bound as favorable planting conditions in the U.S. Midwest offset strong export demand.

Diversify with Commodities

Learn how commodities can provide portfolio diversification, inflation hedging, and alternative returns.

Explore Commodity ETFs