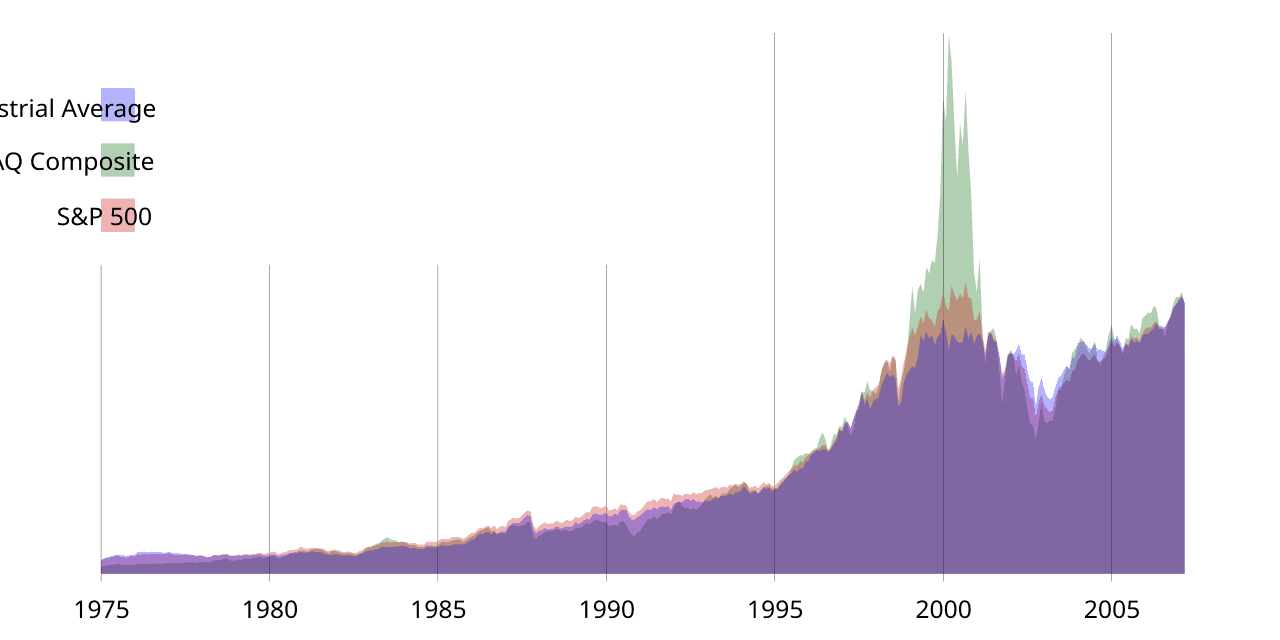

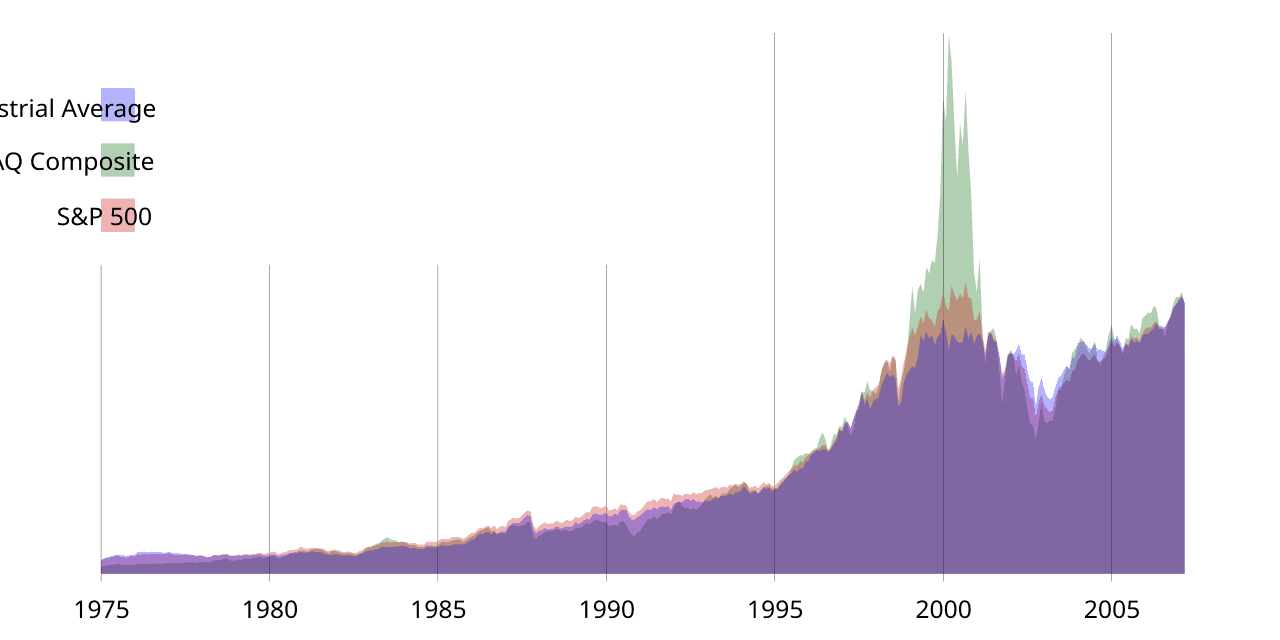

How to Build a Diversified Investment Portfolio in 2026

Learn the fundamentals of portfolio diversification including asset allocation, rebalancing strategies, and how to match your investments to your risk tolerance.

Expert guidance on investing, saving, retirement planning, and building long-term wealth.

Learn the fundamentals of portfolio diversification including asset allocation, rebalancing strategies, and how to match your investments to your risk tolerance.

Compare the best high-yield savings accounts offering 4.5%+ APY. Find the right account for your emergency fund and short-term savings goals.

A detailed comparison of Roth and Traditional IRAs covering tax implications, income limits, contribution limits, and withdrawal rules for 2026.

From the 50/30/20 rule to zero-based budgeting, discover which budgeting method fits your lifestyle and helps you reach your financial goals faster.

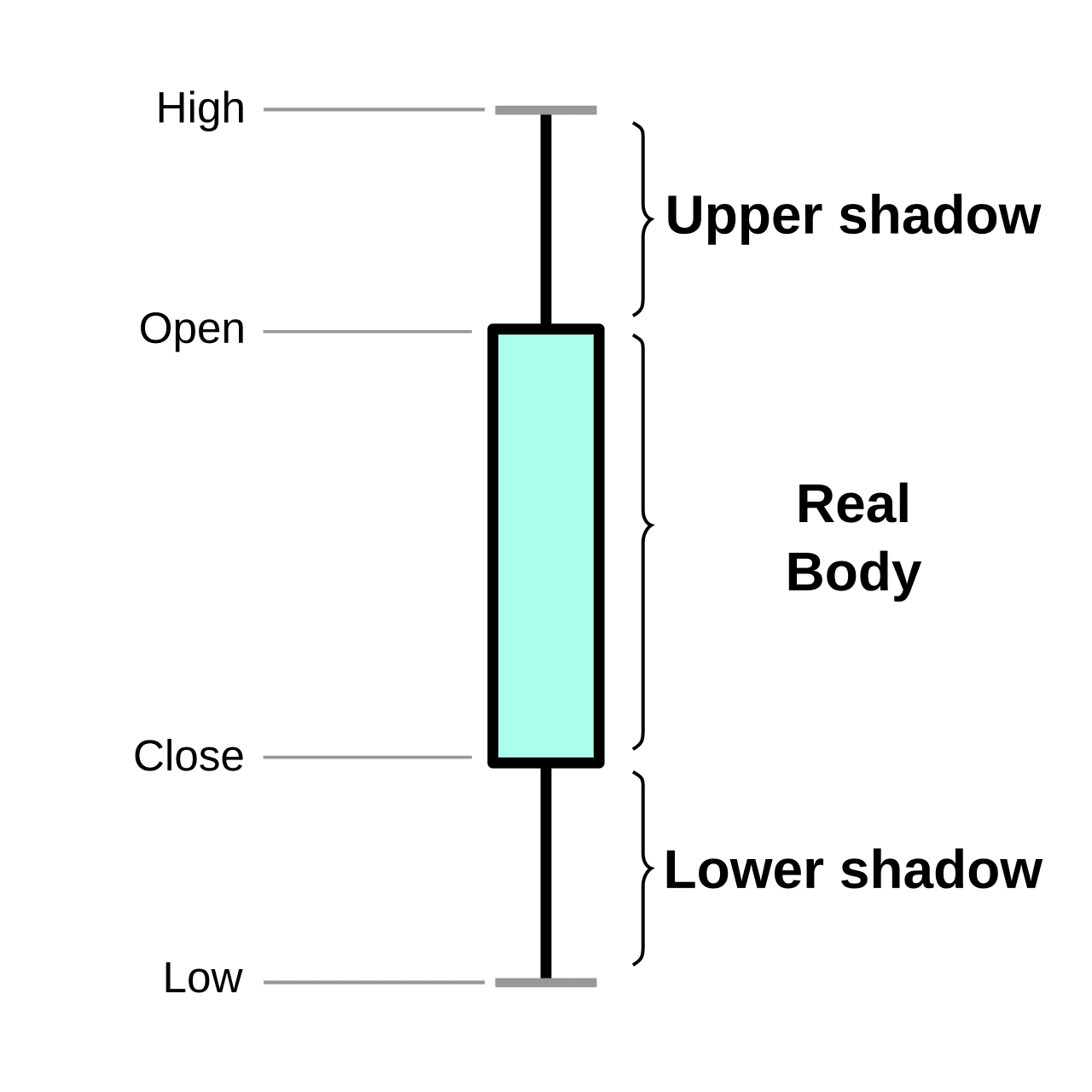

Master the strategy of selling losing investments to offset capital gains taxes. Learn the wash sale rule, timing considerations, and optimal implementation.

Discover why investing a fixed amount at regular intervals reduces risk and improves long-term returns, with step-by-step instructions to get started.

Financial experts recommend 3-6 months of expenses, but your ideal emergency fund size depends on your job stability, health, and family situation.

Learn the five factors that determine your credit score and actionable strategies to improve your score by 50-100 points within 6 months.

Data shows that 90% of active fund managers underperform index funds over 15 years. Learn when index funds make sense and when stock picking can add value.

Compare the debt avalanche vs debt snowball methods, learn about balance transfer strategies, and create a realistic debt payoff timeline.

Get actionable personal finance tips, market insights, and investment ideas delivered every Sunday.